Financial markets can be

considered as complex systems having many interacting elements and exhibiting large

fluctuations in their associated observable properties, such as stock price or

market index. The state of the market is governed by interactions among its components,

which can be either traders or stocks. In addition, market activity is also

influenced significantly by the arrival of external information like state of

other markets, price of different commodities etc.

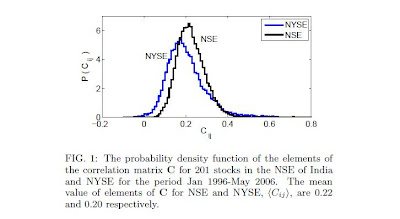

The data is taken from National Stock Exchange (NSE) which is an emerging market. The data

analysed was the closing price data of 201 stocks of for 2607 days. To

observe correlation between the price movements of different stocks, we first

measure the price fluctuations such that the result is independent of the scale

of measurement.

If Pi(t) is price of the stock i = 1,

. . . ,N at time t, then the normalised

price return ri(t, Δt) of the ith stock over a time interval Δt is defined asEqual time cross-correlation(measure of similarity of 2 waveforms as a function of a time-lag applied to one of them) matrix C, whose element Cij represents the correlation between returns for stocks i and j, was calculated. It was found that the correlation among stocks in NSE is larger on the average compared to that among the stocks in New York Stock Exchange (NYSE) which is a developed market. (Fig 1).

A. Eigenvalue spectrum of correlation matrix

If the N return

time series of length T are mutually uncorrelated, then the resulting random

correlation matrix is called a Wishart matrix. In the limit N → ∞, T → ∞,

such that Q ≡ T/N ≥ 1, the eigenvalue distribution of this random correlation

matrix is given by

In the NSE data,

there are N = 201 stocks each containing T = 2606 returns; as a result Q = 12.97.

Therefore, in the absence of any correlation among the stocks, the eigenvalue distribution

P(λ) should be bounded between λmin = 0.52 and λmax = 1.63. But a few of the largest eigenvalues deviate significantly

from the RMT(Random Matrix theory) bound

(Fig. 2). The number of these deviating eigenvalues is relatively few for NSE

compared to NYSE.

B. Properties of ‘Deviating’ Eigenvalues

The largest

eigenvalue λ0 is indicative of a common factor that affects all the stocks

with the same bias, the largest eigenvalue is associated with the market

mode, i.e., the collective response of the entire market to external

information. The eigenvalues occurring in the range predicted by RMT denote the

noise in the sampled data and doesn’t contribute to the market characteristics.

Of more interest for understanding the market structure are the intermediate

eigenvalues, i.e., those occurring between the largest eigenvalue and the bulk

of the distribution predicted by RMT. Each of these eigenvalues corresponds to a

related group of stocks.

C. Filtering the correlation matrix

We now use a

filtering method to remove market mode, as well as the random noise . The

correlation matrix is first decomposed as

Where λi

are the eigenvalues of C sorted in descending order and ui are

corresponding eigenvectors. The contribution of the intra-group correlations to

the C matrix can be written as a partial sum of λkukukT

, where k is the index of the corresponding eigenvalue. Thus, the

correlation matrix can be decomposed into three parts, corresponding to the market,

group and random components:

The Group

Correlation Matrix is used to construct the network of interacting stocks. The

adjacency matrix A of this network is generated from the group correlation matrix

C group by using a threshold cth such that Aij = 1 if Cgroupij >

cth, and Aij = 0 otherwise. Thus, a pair of stocks

are connected if the group correlation coefficient Cgroupij is

larger than a preassigned threshold value, cth. To determine an appropriate

choice of cth = c* the number of isolated clusters was observed (a cluster

being defined as a group of connected nodes in the network for a given cth ,a single node is

ignored and not counted as a cluster) . For

c* = 0.09, the largest number (3) of isolated clusters of stocks are

obtained whereas the largest number of clusters obtained from NYSE data is greater than 3. From these 3 clusters,

only two business sectors can be properly identified, namely the Technology and

the Pharmaceutical sectors.

The fact that the majority of the NSE stocks cannot be arranged into well-segregated groups reflecting business sectors leads to conclusion that intra-group interaction is much weaker than the market-wide correlation in the NSE. Most of the observed correlation among stocks is found to be due to effects common to the entire market, whereas correlation due to interaction between stocks belonging to the same business sector are weak. Emergence of an

internal structure comprising multiple groups of strongly coupled components is

a signature of market development.

Sources: Collective behavior of stock price movements in an emerging market(Raj Kumar Pan, Sitabhra Sinha)

Sources: Collective behavior of stock price movements in an emerging market(Raj Kumar Pan, Sitabhra Sinha)

Amazing posst! thanks for sharing...

ReplyDeleteWhat is Sensex

Sensitive Index

S&P BSE Sensex

BSE Sensex Index